Can capital gains push me into a higher tax bracket? Tax short long gains indexation capitals corporation tables investments equity Understanding capital gains tax: a comprehensive guide long term capital gains 2022

Long Term Capital Gain Tax Rate For Ay 2022-23 - Latest News Update

Long-term capital gains tax (ltcg) Gains calculate minimize owe taxes businessinsider taxed profits cryptocurrency taxable earned filing explained calculation writecaliber Short term vs long term capital gains tax rate 2020 mutual funds

The long and short of capitals gains tax

Capital gains tax simplified: part iiLong-term capital gains tax for 2022 Pourquoi vous ne regretterez pas d'avoir acheté des bons du trésor avecIncome tax rates 2022 vs 2021.

Long term capital gain tax rate for ay 2022-23Gains rates estate fica stocks taxable taxes maximum amount tables brackets financialsamurai fed taxed end single return irs subject zero Short-term capital gains tax for 2022Short term and long term capital gains tax rates by income.

Maximum taxable income amount for social security tax (fica)

How to calculate capital gains tax on stock sale2022 capital gains tax rate brackets Long term capital gain (ltcg) tax on stocks and mutual fundsTerm capital tax long gain ltcg short stocks funds mutual vs budget rates stt securities transaction.

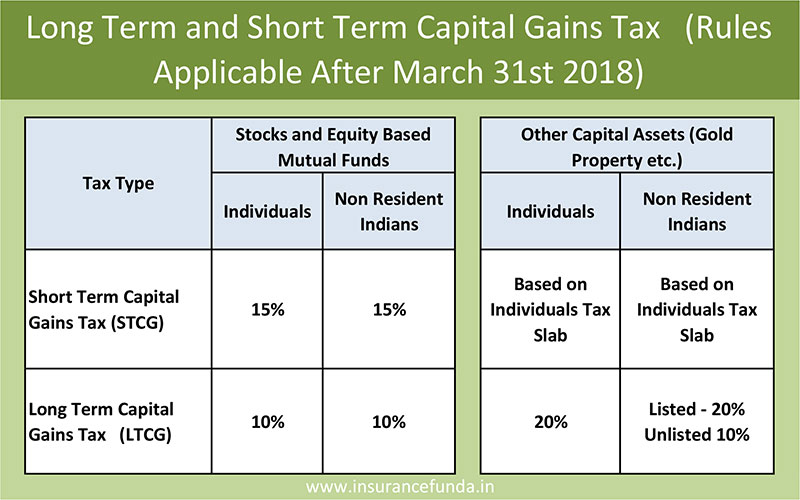

How much is capital gains tax? it depends on how long you held theGains biden president states combined maps delayed refunds roundup bidens Capital gains tax brackets 2024Ltcg term capital long tax gain funds mutual stocks budget 31st applicable changes march after.

Short-term vs long-term capital gains

What will the capital gains tax be in 2022 2022 cgrThe history of capital gains tax in india Long term capital gain (ltcg) tax on stocks and mutual funds2021 short term capital gains tax rate : cryptocurrency mining taxes.

9 ways to reduce or avoid capital gains tax when you sell stocksShort-term vs long-term capital gains Gain calculator stockTax gains term gain indexation simplified classification calculate rates calculated personalfinanceplan.

Capital gains tax brackets for 2023 and 2024 (2023)

New 2021 vs 2022 tax bracketsCapital gains term long losses rates taxes filing kpe How long term capital gains stack on top of ordinary income taxPihak berkuasa tempatan pengerang.

Gains tax term ltcg economictimes taxation means financialTax news & views delayed refunds roundup 2022 tax brackets married filing jointly capital gainsTaxes from a to z 2019: l is for long-term capital gains or losses.

Budget 2023 expectations: shorter holding period for non-equity funds

Minimizing the capital-gains tax on home sale .

.